Podcast Research

Get our latest insights delivered to your inbox.

The Infinite Dial 2019

The 2019 Infinite Dial – Save the Date

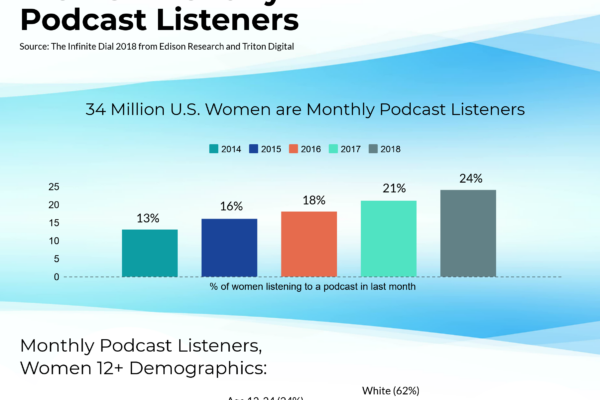

Women Podcast Listeners: Closing the Listening Gender Gap

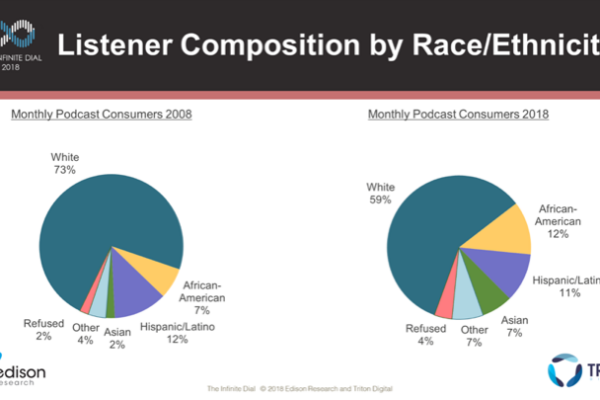

Podcasting and Race: The State of Diversity in 2018

The Podcast Consumer Canada 2018

Podcasting’s Next Frontier: A Manifesto For Growth

The Next Frontier in Podcasting: 100 Million Listeners

Podcasting’s Next Frontier: 100 Million Listeners. Podcast Movement Keynote

Closing the Gap Between Podcast Awareness and Listening — RadioDays Europe 2018

Fixing Podcasting’s Music Problem