Consumer Surveys

Get our latest insights delivered to your inbox.

The 2019 Infinite Dial – Save the Date

“Radio” Listening Dominates Audio In-Car

Women and Economic Anxiety

Fifty-three million U.S. Adults now own at least one Smart Speaker

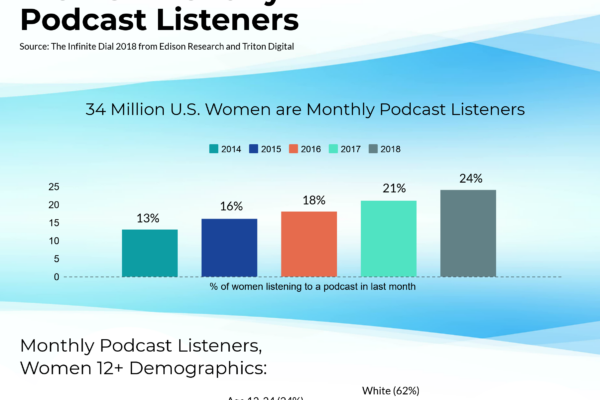

Women Podcast Listeners: Closing the Listening Gender Gap

Americans and the Gig Economy

Moms on the “Mother Load” 2018

Marketplace and Edison Research Reveal a Dramatic Shift in How Partisans Perceive Economic Data

Moms on the Mother Load

New Study: Moms on the Mother Load